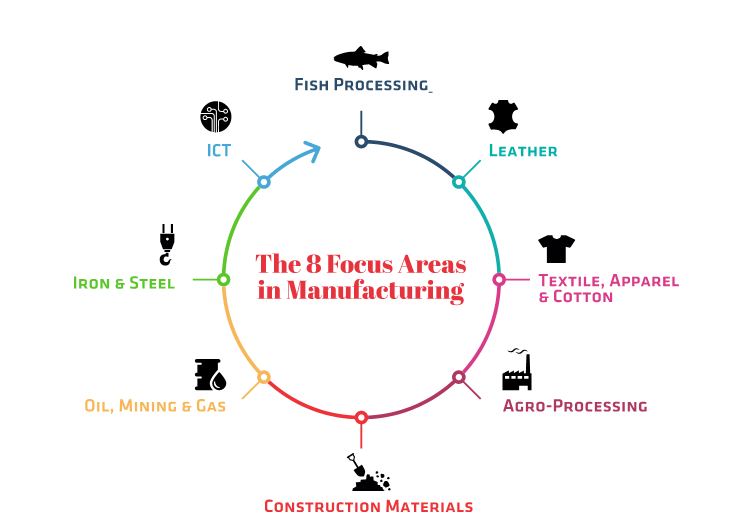

Investment opportunities exist in nearly all the sectors and especially in agro based industries, machinery and building materials, furniture and paper products, garments and textiles, jewellery and watch manufacture, food processing, cosmetics, pharmaceuticals, electronic goods, solar technology products; IT/Data processing, tourism, banking and financial services, housing, roads, ports, railways and energy sector.

Direction of Trade

African countries continue to be the major market for Kenya’s exports followed by EU. In 2002 the market share of total exports to African countries and EU stood at 48.9% and 28.5% respectively.

Among the EU countries UK continues to be the leading market for Kenyan exports with a market share of 39.6% of exports to the region. UK was Kenya’s second leading destination for Kenyan exports after Uganda.

Incentives

Kenya embarked on a comprehensive program of economic reforms designed to deregulate the economy and put it on the path of rapid employment generating growth.

Sustained effort by the government to tighten fiscal and monetary policies since mid 1993 has been effective in stabilizing the economy and contributing to the revival of economic growth.

Stable macro-economic conditions, liberalized markets, and more operations of the strategic public enterprises are expected to enhance the level and the efficiency of private investment, and result in increased income and job creation.

The government encourages investment and the Kenyan economy remains open to foreign investors. There are no restrictions on foreign investment, foreign ownership, and repatriation of profits or capital.

Investment in the Export Processing Zones (EPZs) and Manufacturing Under-Bond (MUB) enjoys a 10 year tax holiday followed by 25% tax rate for the next 10 years and exempt from import duties, VAT, and Sales Tax.Foreign ownership in listed Kenyan companies is generally restricted to 40% in the aggregate and 5% for each individual investor.

There is manufacturing – Under Bond Scheme in operation. The Export Processing Zones Authority (EPZA) operates in 39 Zones, (37 private, 2 public).

Taxation

Corporate tax presently stands at 30%. Withholding tax on dividends is 5%. However, inter-corporate dividend payments between closely held companies are exempt from withholding tax.

Dividends received by financial institutions as trading income are not subject to tax.Value Added Tax (VAT) is levied on the supply of goods imported into or manufactured in Kenya, and taxable services imported or provided in Kenya.

The standard VAT rate is 16%. Unprocessed agricultural products are exempt from VAT. Inputs into health care, education and agricultural sectors are zero-rated. All exports of goods and services are zero-rated.Excise duties are levied on beer, tobacco products, matches, spirits, wines, mineral water and biscuits (confectioneries).

Personal tax is charged on the income earned in Kenya by any person resident in Kenya. Individual income tax is taxable at rates graduated to 30%.

Tax allowances are provided for all individual taxpayers. Taxable income includes all business income, employment income, dividends, interest and property income.

Market Access

Over and above the domestic demand, Kenya’s membership of several regional bodies provides an expanded market.

Membership of the East African Community (EAC) and the Common Market for Eastern and Southern Africa (COMESA) guarantees a market of approximately 300 million people, and provides free movement of goods and services.

Exports from Kenya enjoy preferential access to the European Union under the ACP-EU framework.

In addition, Kenya is one of the initial beneficiaries of the African Growth and Opportunity Act (AGOA), which provides for preferential market access in textiles to the USA.